U.S. tariff hikes reshape global gym flooring export dynamics, prompt industry adaptation

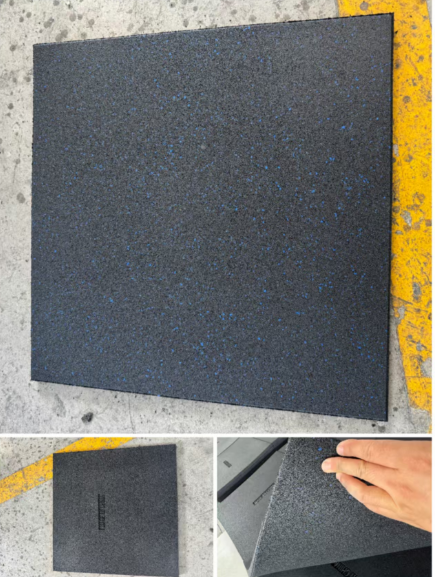

The recent imposition of elevated U.S. tariffs on imported gym flooring products, including rubber rolls, interlocking mats, and PVC tiles, is sending shockwaves through the global fitness equipment supply chain. With tariffs on certain categories rising from 7.5% to 25% under Section 301, Chinese manufacturers—who dominate 40% of the global gym flooring market—face mounting pressure to recalibrate export strategies.

Cost Surge and Market Shifts

American importers, grappling with inflated costs, are increasingly diverting orders to Southeast Asian suppliers or opting for domestic alternatives. Data from the International Trade Commission reveals a 15% YoY drop in U.S. imports of Chinese rubber flooring in Q1 2024, while Vietnamese exports surged by 22%. "The tariff hike erased our price advantage overnight," said Mr Zhang, CEO of a Hebei-based flooring exporter. "Clients now demand 20% discounts, which is unsustainable."

Strategic Pivots in the Gym Flooring Industry

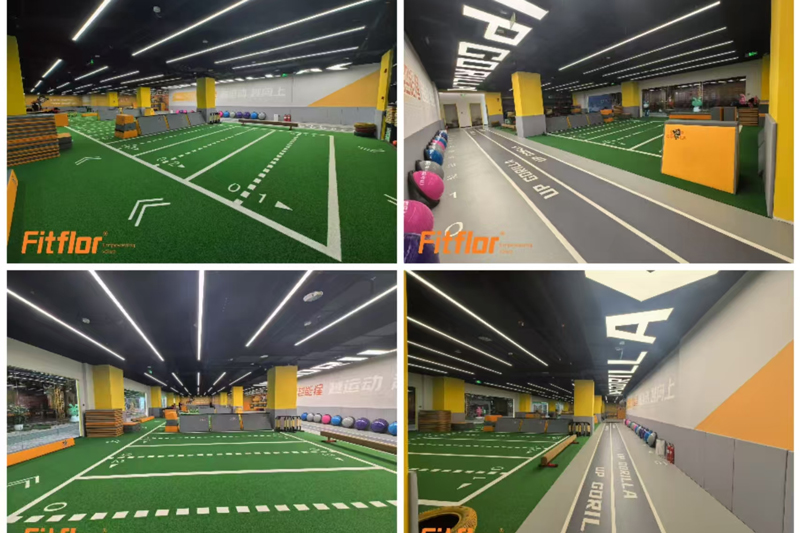

Manufacturers are accelerating localization efforts to bypass tariffs. FITFLOR, a leading sports flooring brand, would like to open a factory in Mexico to serve North American markets duty-free. Others are investing in premium product lines, such as eco-friendly recycled rubber tiles, to justify higher pricing. "We’re focusing on ASTM/CE-certified products that meet U.S. safety standards but face less price sensitivity," noted industry analyst Emily Carter.

Broader Implications

The tariffs have inadvertently fueled innovation. Companies like DuraMat are introducing hybrid flooring solutions with embedded IoT sensors for gym performance tracking, targeting high-end commercial clients. Meanwhile, European markets like Germany and France are emerging as alternative destinations, with EU imports of Chinese gym flooring rising 18% this year.

Outlook

While short-term disruptions persist, experts predict consolidation among smaller exporters and a long-term shift toward value-added, tariff-resilient products. As the U.S. fitness industry grows—projected to hit $45 billion by 2025—the battle for market share will hinge on agility and innovation.